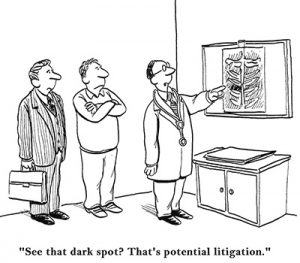

Asset Protection planning gives your clients the option to legally defend themselves from the frivolous lawsuits that are often focused their way. Unfortunately these individuals are a huge target for a variety of reasons:

- They are in a high net-worth, and high liability profession.

- They have high visibility, traceability, and or collectability as a member of the community.

- Their extensive government Compliance Requirements, from HIPAA to wage & hour, which are often difficult to meet or even to be aware of.

- Their position as an Employer with Employees as employee related lawsuits are becoming a huge issue.

- Their ownership in a business and liability generating assets.

- Their investments in liability generating assets such as rental real estate.

- Their children and their activities (especially driving).

- Their service on foundations or boards, whether corporate or non-profit.

Any one of these factors alone, makes them a target for lawsuits, but the combination of several, accurate or not, creates a need for proactive planning to ensure that their assets are protected from predators.

Estate Planning is Critical, but Won’t Protect Their Assets

The RLT does not, however, shelter your clients from any sort of lawsuit exposure during their lifetime. Asset Protection Planning, in contrast, does offer such protection, and will complement your estate planning.

In addition to the obvious exposures created by wealth, high-income, and a high-risk profession, your clients also expose themselves to every-day risks like, driving a car, owning real estate, or having children that drive.

Basic Risk Management is Critical, but Insufficient

Your clients may have done a good job already with basic level risk management measures like insurance or even creating a business entity for some of their assets. These are important first steps, but they fall short of having an effective legal shield that covers the gaps which insurance and a ‘corporate veil’ leave open. Asset Protection planning can help cover these gaps with comprehensive legal defenses that can be thought of as “net-worth insurance” that places your clients personal assets beyond the reach of future creditors.

“Net-Worth Insurance” removes the economic incentive for a plaintiff to sue, except for maybe up to the limits of their insurance coverage. Why pursue a long and expensive court proceeding if the assets cannot be reached?

Procrastination is Not an Option

The time to act is now when waters are calm. Hoping that they won’t get sued is not a plan, it is just wishful thinking.